Trade Trends

Trump 2.0 Proposed Tariff: A Glance at the Wood Products Sector

Using an in-house CGE model we (i.e., CINTRAFOR) developed an analyses of the potential impact of the proposed 25% tariff on Canada and Mexico and the possible retaliatory tariff. This model was developed before any tariffs are imposed and hence speculative in nature. This analysis was done at the national level with an emphasis on the wood product sector. Based on the data, I developed an impact for the state of WA.

We modeled two scenarios, which are as follows:

Scenario 1: President Trump’s imposing a 25% tariff on all products from Canada and Mexico (25% Tariff)

Scenario 2: President Trump’s imposing a 25% tariff on all products from Canada and Mexico along with the corresponding retaliation from Canada and Mexico of 25% tariff (25%Tariff Retaliation)

The proposed tariffs under President Trump’s administration present significant implications for the U.S. wood sector, particularly concerning trade dynamics with Canada and Mexico. While the intent is to bolster domestic industries and rectify trade imbalances, the anticipated consequences reveal a complex landscape. The 25% tariffs, coupled with retaliatory measures, are likely to elevate product prices, disrupt supply chains, and negatively impact sectors dependent on imported wood products.

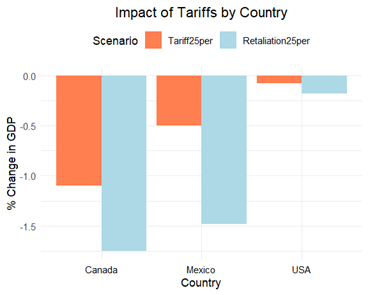

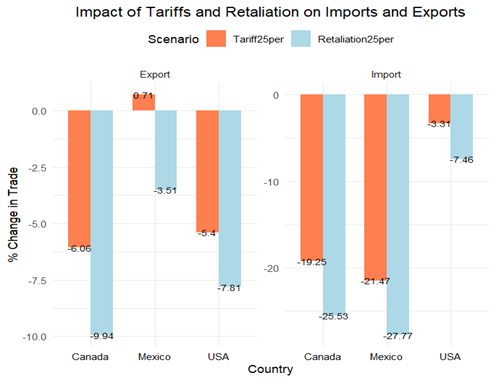

Notably, while Canada and Mexico face substantial declines in GDP and sector outputs, the U.S. economy appears relatively insulated, with minimal impacts on GDP. However, this insulation should not lead to complacency. The declining import volumes and the potential for retaliatory tariffs could disrupt the intricate interdependencies that define North American trade. The long-term standing of US wood products can further deteriorate in the global market as a result of these tariffs, similar to what we experienced in post-US-China trade war.

Moreover, Mexico’s ability to capitalize on the tariff situation presents a strategic challenge, as it may emerge as a more competitive player in the wood market. As policymakers, it is crucial to consider the long-term ramifications of these tariffs, not only for immediate economic impacts but also for fostering sustainable trade relationships. A balanced approach that promotes domestic growth while mitigating adverse effects on trade partners may yield more favorable outcomes for all stakeholders in the wood sector.

From Figure 1 we can observe the severity of the tariffs and the counter tariffs of the three economies. In the short run Canada and Mexico will see a severe contraction in their respective economies, with more than 1% net GDP contraction under some of the scenarios. The percentage reduction in trade presented in Figure 2 reaches around 10% under some of the scenarios highlighting the interdependencies of these three economies.