Increasing Demand for Wood Pellets in Japan and South Korea

Authors: Hemalatha Velappan and Indroneil Ganguly

The need for wood pellets is increasing in both Japan and South Korea with the two countries set to become the largest wood pellet consumers in the world (Dafnomilis, Lodewijks, Junginger, & Schott, 2018). The ambitious renewable energy expansion targets for the near future and the policies to aid that expansion are the primary reason for this expected increase in demand.

Japan

Japan has set a biomass power target of 3.7-4.6% by 2030, which would be 20% of its renewable generation (Strategic Energy Plan, METI). This target would create an annual biomass demand of around 13-18 million T by 2030 (Demand for Biomass Pellets Chips from Biopower Producers in Japan South Korea, Forest2Market). However, as of 2018, Japan was home to 145 operating pellet facilities that produced just 125,000 T annually, a small quantity compared to modern export wood pellet facilities in North America and Europe (Parton, 2019). This deficit in supply is filled by imports which passed one million T in 2018.

In addition to the renewable expansion targets, the demand for wood pellets was spurred by favorable Feed-In Tariff (FIT) prices. FIT prices are designed to decline systematically and eventually be phased out. The most recent FIT price was 40% lesser than the initial price (Tetsuo, 2019). Despite the falling FIT prices, imports of wood pellets continue to increase as biomass power plants continue to expand.

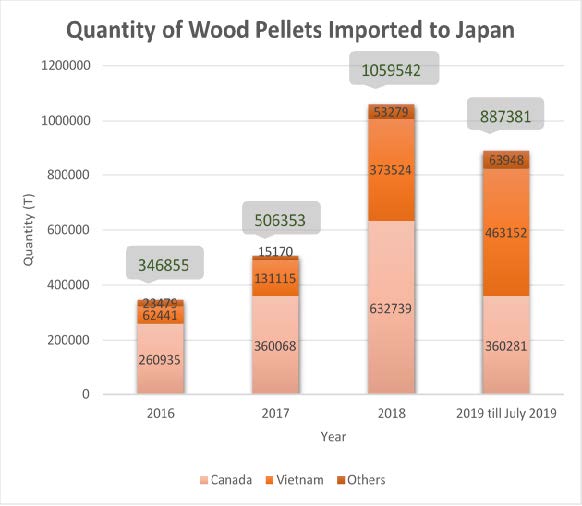

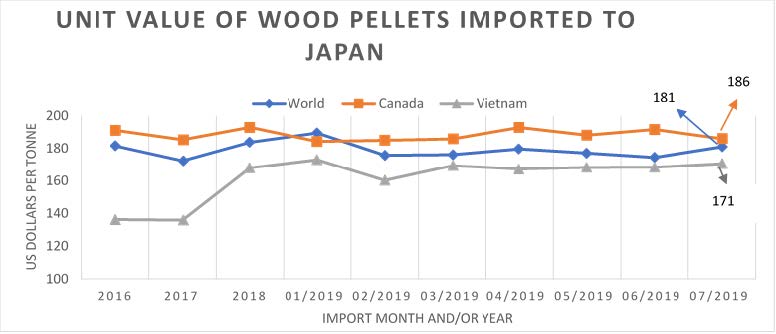

Between 2017 and 2018, a staggering 109% increase in wood pellet imports was observed with a ten dollar increase in average import price per ton wood pellets. Because Japan imports high quality wood pellets, import prices have improved despite falling FIT prices. As of July 2019, Japan had already imported 75% more wood pellets than the total amount in 2017. Canada has been the major supplier, meeting 60% of Japan’s total wood pellet imports in 2018. However, this trend is shifting. Since early 2019, Vietnam is emerging as a major exporter contributing 52% of Japan’s total imports. Canada remains a close second at 40%. Total exports from Vietnam July year-to-date already exceed the total 2018 quantity by 24%.

Finally, a requirement to obtain a sustainability certification for Palm Kernel Shell (PKS) and palm oil is predicted to create an even greater tailwind for wood pellet demand. According to the draft version of these new rules (released on August 22, 2019), the Biomass Sustainability Working Group decided that the content of the biomass will be examined under criterion such as environment, social and labor, food conflicts, and governance (Confirmation Contents and Means for Sustainability of Biomass Power Generation Fuel, 2019). It states that by-products such as PKS must be sustainable from the factory where it is generated and third-party authentication equivalent to RSPO is required. The requirements apply after a grace period which ends April 1, 2022. PKS supply is highly fragmented with many small farmers and will be difficult to certify. Due to this scrutiny, some portion of current imports from Malaysia and Indonesia will be curtailed (Strauss & Kusano, 2019). Wood pellet imports could increase as a sustainable substitute.

South Korea

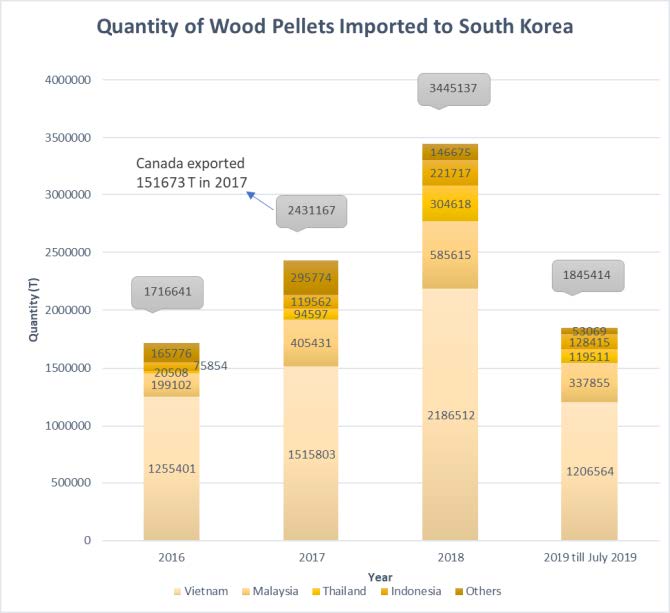

In 2018, South Korea (hereafter Korea) revised the Renewable Portfolio Standard (RPS) ramp up schedule to reach 9% by 2022 and 10% by 2023-2024. Due to the increasing adaptation for RPS, Korea has been consuming 1.5-3.5 million ton of wood pellets annually since 2014. Vietnam is the top supplier, although their market share is declining. In 2017, Vietnam supplied 73% of Korea’s imported wood pellets, but dropped to 63% in 2018. Due to the varying Renewable Energy Certificate (REC) weightings, South Korea struggles to get long term contracts with North American pellet producers which is the reason Korea has Malaysia, Thailand, and Indonesia as its next largest suppliers.

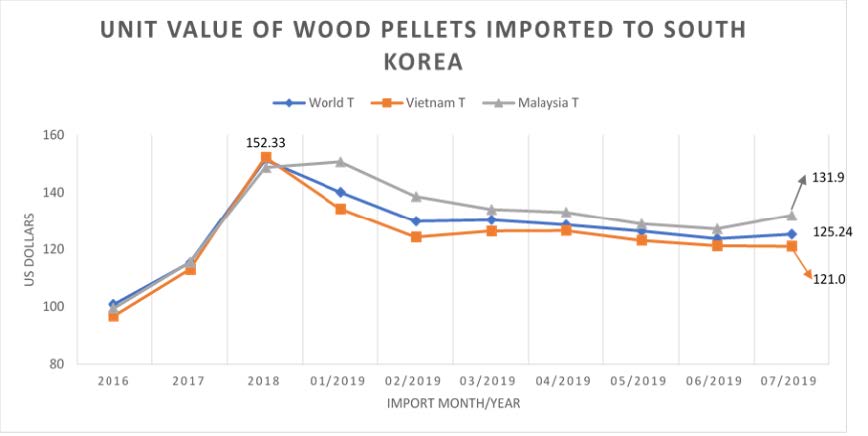

Between 2017-2018 wood pellet imports grew by 40%, then began slowing in 2019. Although it’s too early to know if there will be a decline, experts predict a slump and are expecting it to continue through 2020. The main reason for this decline is attributed to the new REC weightings released in June 2018. According to these new rules, growth in co-firing is no longer supported and the REC weightings were significantly lowered for imported wood pellets, while support for domestic wood pellets, which have a very limited supply, was increased. This policy change shifted the RPS obligators to buy low priced RECs over co-firing wood pellets, pushing down the world average unit price of pellets imported to Korea, which stood at $152 in 2018, to $125. Earlier it was predicted that Korea could reach more than 8 million tons of wood pellet demand by 2025 (Strauss, 2016), however, this could change if the present situation continues. Korea has penalties for non-compliance to RPS as a maximum of 150% of trading prices for REC. With these latest developments, the total cost incurred by using pellets would exceed this non-obligation penalty. Such a no- or low-profit situation will surely dampen Korea’s pellet imports (Strauss, 2019).